Republic Day Sale: Get ₹1,500 Discount

Apply Code "FLAG26" at Checkout

The Quality of Your Knowledge Determines the Quality of Your Work

In-Depth Practical Accounting & Taxation Mastery Course with Law

Get all Basic to Advance Accounting, GST, TDS, TCS, ITR, Salary Processing, BRS, Petty Cash, Practical in Tally Prime, Balance sheet Finalisation and Excel Course in This Offer

Latest Updated Course, Last update on 15th February 2026

100% Money Back Guarantee! *

Practical Session:- Highly Interactive Practical Sessions

Anywhere Access:- Access the Course anywhere you want, Mobile, PC, Laptop & TV

Certificate:- Get Government ISO Certified Certificate

Unlimited views:- Course with unlimited views.

LIFETIME VALIDITY:- watch your course whenever needed

Lifetime support:- Full support for lifetime

Hurry Up! Don't Miss The Opportunity

Get 62% Discount Now

₹15,999

₹ 5997 only for Today

Taxation Mastery Course

Introducing…

The Most Profitable Way To Grow

your Career In Accounting & Taxation

• Learn The Art of Accounting & Tax Consultants

• Charge Premium amount as Tax Professionals

• This Course Will Make You Professional Accounting & Tax Expert

• 125 Hours+ In-Depth Structured Course Content

Get ready for the "Practical Course in GST ITR & TDS"! It's a Professional Program that helps you understand Accounting & taxes like Goods and Services Tax (GST), Income Tax Returns (ITR), and Tax Deducted at Source (TDS). This course is for both beginners and experts who want to get better at dealing with taxes. We focus on practical stuff.

TOP BENEFITS

You Need Only "Accounting" & "Taxation Course" to become Tax Professional, And You Are Getting Both As A Part Of This Exclusive Offer.

Hurry Up!

CLAIM YOUR SPECIAL BONUSES WORTH ₹6596

BONUS 1:

Advanced Excel Course Worth ₹2599

This Excel course offers a complete overview from basic to advanced concepts, including practical assignments like payroll preparation, GST calculation, TDS calculation, and Profit Calculation. Emphasizing a practical approach, it equips learners with valuable Excel skills for real-world use.

BONUS 2:

Accounts Course

Worth ₹3997

Learn the fundamentals of accounting, including types of accounts, journal entries, ledger creation, trial balance, BRS, Petty Cash, and final accounts preparation with adjustments, enabling practical financial management and reporting skills.

What Our Students Says about us...

We Have impacted many of students Life Like You

It's Your turn Now,

Hurry Up! Don't Miss Out On These

Limited Time Fast Action Bonus!

With This Exclusive Course, You’ll Get 2 Monthly Live Q&A Sessions & Updates.

- checkAsk your Questions

- checkInteract with your Mentor

- checkInteract with profesional

- checkLearn from other's Query

- checkGet Exposure

- checkGet Career Growth,

Wait!! You'll Also Get These

EXTRA FREE BONUSES If You Buy Today

BONUS 1:

Free Lifetime Access of the Course and Bonuses

(Worth ₹3599/year)

- checkAccess in Mobile

- checkAccess in Laptop/Computer

- checkAccess in TV

BONUS 2:

Accounting in Tally Prime

(Worth ₹3997)

In "Accounting in Tally prime" you'll master the art of efficient bookkeeping and financial management through hands-on learning with Tally software.

- checkCreate Company in Tally Prime

- checkTally Features

- checkCreate Accounts Masters/Ledger In Tally Prime

- check50 Voucher Entries In Tally Prime

- checkQuotation, Purchase Order, Delivery Challan & Receipt Challan.

- checkCreate stock item / Masters

- checkCreate Locations/Godown

- checkCreate New Vouchers

- checkVoucher Entries (F4, F5, F6, F7, F8, F9 and others)

- checkPos (Point of Sale) in Tally Prime

- checkName of Class in Voucher

- checkTrade Discount (Buy one get one free)

BONUS 3:

GST in Tally Prime Course

(Worth ₹3599)

In this Course, you'll gain practical expertise in managing GST transactions effectively through this comprehensive GST Tally Prime course.

- checkGST Configuration in Tally Prime

- checkCreate GST Ledgers (i.e.Purchase GST, Sales GST, Export, Import, SGST, CGST, IGST, Debtors, Creditors & others)

- checkPass all types of GST voucher entry in Tally Prime

- checkDebit Note and Credit Note in Tally Prime

- checkMake Tax Invoice within a minutes in Tally Prime

- checkExempted Entry in Tally Prime

- checkTaxable Entry in Tally Prime

- checkE Way Bill in Tally Prime

- checkE Invoice in Tally Prime

- checkAdvance received under gst in tally prime

- checkAdjustment against advance received in Tally Prime

- checkExport Accounting in Tally Prime

- checkImport Accounting in Tally Prime

- checkGST Refund Entry in Tally Prime

- checkExchange Variance in Tally Prime

- checkRCM against Service in Tally Prime

- checkRCM against Goods in Tally Prime

- checkRCM adjustment & Payment in Tally Prime

- checkCapital Goods in Tally Prime

- checkITC Reversal in Tally Prime

- checkEneligible ITC Accounting in Tally Prime

- checkGST Payment in Tally Prime

- checkGST Offset Entry in Tally Prime

BONUS 4:

TDS Practical in Tally Prime

(Worth ₹2987)

In this Course, you'll gain practical expertise in managing Tax Deducted at Source effectively through this comprehensive TDS Tally Prime course.

- checkTDS Configuration in Tally Prime

- checkCreate Masters under TDS in Tally Prime

- checkCreate Section wise TDS Ledger (i.e. 194C, 194J, 194I and Others)

- checkDifference payment code 200 and 400

- checkTDS Payment Code in Tally Prime

- checkThreshold Limit in Tally Prime

- checkTDS Deduction in same voucher in Tally Prime

- checkTDS deduction in Journal Voucher in Tally Prime

- checkTDS Deduction in accordance with exemption limit in tally prime

- checkTDS Payment in Tally Prime

- checkTDS challan reconciliation in Tally Prime

- checkTDS Accounting in the books of deductee

BONUS 5:

Lifetime Premium Support

(Worth ₹3599/month)

- checkCalling Support

- checkWhatsApp Support

- checkOnline Community Support

- checkDirect Support by Your Teacher Md Shafi Ahmad

BONUS 6:

Balance Sheet Finalization Course

(Worth ₹1987)

Learn How To Finalize the Trading, Profit & Loss A/c, and Balance Sheet

BONUS 7:

Online Community of Professionals

(PriceLess)

You will get lifetime access to "The Account" Community. where you can get your doubts resolved by the trainers themselves, grow your network, get clients, Job Opportunities, and a lot more. As you know we also have MNC's students so get in touch with them also and grab the opportunities!

BONUS 8:

Task, Assignment & WorkSheet

(Worth ₹3797)

Tasks, assignments, and worksheets provide valuable practice opportunities for students to apply and reinforce their learning. They enhance problem-solving skills, critical thinking, and knowledge retention. Regular practice with these tools helps students grasp concepts better, build confidence, and achieve academic excellence.

Premium Bonus #1 - Complete Notes Bundle In Hindi & English

(₹9,284 Value)

- checkComplete Notes of Basic Accounts(Worth ₹997)

- checkNotes for Journal Entry in PDF Format (Worth ₹399)

- checkNotes for Ledger Accounts in PDF Format (Worth ₹599)

- checkGST Notes(Worth ₹2997)

- checkIncome Tax Return Notes (Worth ₹1997)

- checkTax Deduction at Source (TDS) Notes (Worth ₹1497)

- checkExcel Notes (Worth ₹399)

- checkBalance Sheet Notes (Worth ₹399)

Premium Bonus #2 - Most In-Demand Sheets Bundle

(₹4,691 Value)

- checkFull GST Worksheet in Excel(Worth ₹599)

- checkGST Work Sheet in Excel Format (Worth ₹399)

- checkIncome Tax Calculator in Excel for Salary (Worth ₹599)

- checkIncome Tax Calculator in Excel (Worth ₹599)

- checkSalary Sheet in Excel (Worth ₹399)

- checkGST Invoice Excel Sheet (Worth ₹299)

- checkFully Automated Attendance Sheet in Excel (Worth ₹399)

- checkBalance Sheet with Schedule in Excel Format (Worth ₹399)

- checkFully Automated Salary Processing Sheet in Excel (Worth ₹999)

Hurry Up! Don't Miss The Opportunity

Get 62% Discount Now

₹15,999

₹ 5997 only for Today

Taxation Mastery Course

These Bonuses Are Super Exclusive. You Won't Find Them Anywhere Else. They Are Only Available With This Exclusive Offer Right Now.

Get Your Hands On.....

Md Shafi has empowered thousands

all over the India

Who Is The Course For...

Structured Course

Commerce Students

Accountants

CA, CMA, CS

Advocates / Lawyers

Job Seekers

Small Business Owners

Tax Practitioner

TAX Officers

Over 10,000+ Happy clients

What People Say About Our Product

Its a great Course to learn Accounting and Taxation from Basic to Advanced

Its a great Course to learn Accounting and Taxation from Basic to Advanced

MD Shafi Ahmad

Its a great Course to learn Accounting and Taxation from Basic to Advanced

Its a great Course to learn Accounting and Taxation from Basic to Advanced

MD Shafi Ahmad

Its a great Course to learn Accounting and Taxation from Basic to Advanced

Its a great Course to learn Accounting and Taxation from Basic to Advanced

MD Shafi Ahmad

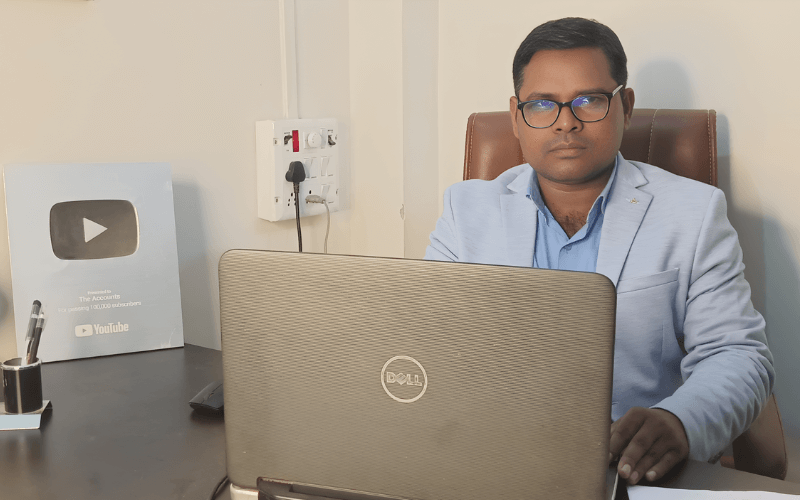

"Meet Your Instructor"

MD shafi Ahmad

Expert in Accounting & Taxation

- Professional in Accounts & Taxation with over 18 years of extensive experience in the field.

- Winner of multiple prestigious awards in the taxation field, recognizing his outstanding contributions

- Worked in India and Oman, gaining valuable insights into international financial systems.

- Passionate teacher & Tax Professional for the last 2 decades, imparting knowledge to 1,00,000+ eager students in India.

- His teaching has been so effective that many of his students have landed jobs in big companies (MNCs).

- Committed to democratizing financial knowledge and making it accessible to all.

- Driven by a genuine desire to empower individuals and businesses for financial success

- He also has a YouTube Channel "The Accounts" which has more than 4.25 Lakhs+ Subscribers.

Risk-Free

Full 30-Day Money-Back Guarantee*

If the lecture you've purchased is not delivered as promised, we offer a full money-back guarantee. Your satisfaction is our priority, we will give you an “immediate” refund. Yes, even if you ask for it on the 30th day. So in other words, this is free to try out Quite simply, even we don't want your money if we do not able to provide promised content.

Claim All Bonuses+ Premium Support & Free Sheets & Notes Now!

Get Lifetime Validity + Support

Get 62% Discount Now

₹15,999

₹5997 only for Today

Taxation Mastery Course

Course

Top Notch Features That...

Turns Your Imagination Into Massive Income

Even If You Don't Know Anything About Taxes!

LIFETIME VALIDITY

Enroll in our course and enjoy the perk of "Lifetime Validity," granting you continuous access to course materials and updates, ensuring your knowledge remains relevant and accessible indefinitely.

Clear MNC interviews

you'll acquire the expertise and confidence to clear MNC (Multinational Corporation) interviews, paving the way for exciting career opportunities in top global companies.

Community of Professionals

you'll join a network of like-minded individuals, where you can engage in valuable discussions, share insights, and seek advice, fostering professional growth and collaboration opportunities.

Lifetime support

means that assistance, guidance, and resources will be available to individuals indefinitely, throughout their entire life, to help them with any challenges or needs that may arise.

support on client work

We offer dedicated support to our students during their client work, providing guidance and resources to ensure successful project outcomes and strengthened client relationships.

Anywhere Access

With our course, you can enjoy "Anywhere Access," allowing you to study and learn at your convenience from any location with an internet connection, providing flexibility and ease of learning.

GST COURSE

You will be Learning the Following things...

Introduction to GST

- checkGST Rule in India

- checkConcept of One Nation One Tax

- checkHow GST works

Supply under GST

- checkConcept of supply

- checkComposite and mixed Supply

- checkTaxability of composite & mixed Supply

Charge of GST

- checkCharge of GST (GST Rate)

- checkLevy & collection of GST (Input & Output)

Composition Levy in GST

- checkComposition levy for traders & manufacturer

- checkComposition levy for restaurant services

- checkComposition levy for other services

Registration in GST

- checkConcept of the taxable person

- checkPerson liable for GST registration

- checkProcedure for registration

- checkCancellation of registration

- checkPractical session on GST Registration

- checkDocuments required for GST Registration

RCM in GST

- checkDescription of RCM under GST

- checkRCM on goods

- checkRCM on Services

- checkRCM from unregistered purchase

E Way Bill

- checkConcept of E Way Bill

- checkEligibility of E Way Bill

- checkDescription of All Sub type outward Supply & Inward Supply

- checkPart A and Part B in E Way Bill

- checkCancellation of E Way Bill

- checkWho will make the E Way Bill

- checkOnline E Way Bill Creation

- checkOffline E Way Bill Creation by Tally Prime

- checkReview of E Way Bill Portal

Export and Import

- checkRules of Export under GST

- checkRules for SEZ

- checkRules of Import under GST

- checkExport with IGST

- checkExport without IGST

- checkLUT

- checkIGST Refund

- checkDuty Drawback

Exempt Supply in GST

- checkExemptions of goods from GST

- checkExemption of services from GST

Value of Supply in GST

- checkCalculation of value of goods and services in GST

- checkValuation Rules for goods and services

Place of Supply in GST

- checkPOS of services within India

- checkPOS of goods within India

- checkPOS of goods outside India

- checkPOS of services outside India

Advance Ruling in GST

- checkQuestion for which Advance ruling can be sought

- checkAAR and AAAR

- checkProcedure for obtain Advance Ruling

- checkRectification of mistake

- checkAdvance ruling to be void in certain cases

Input Tax Credit in GST

- checkConcept ITC under GST

- checkSec 16 Eligibility & Conditions for ITC

- checkClause (aa) of sec 16(1) added by FA 2021

- checkSummary of sec 16

- checkSec 17 Apportionment & Block Credits

- checkSec 17(5) Block Credits in GST

- checkRule 42 apportionment of input & input services

- checkRule 43 apportionment of capital goods

- checkSec 18 ITC in special circumstances

- checkITC Forms in GST

- checkList of sections and rules related to ITC

- checkRule 36(4) 5% provisional ITC

- checkManner and utilisation of ITC

- checkRule 86A Condition of use of electronic credit ledger

- checkRule 86B Restriction on the use of electronic credit ledger

- checkHow scams and bill trading happen in GST

Types of Returns Forms in GST

- checkOverview of GSTR 1

- checkOverview of GSTR 2A

- checkOverview of GSTR 2B

- checkDifference between GSTR 2A and 2B

- checkOverview GSTR 3B

- checkOverview of GSTR 4

- checkOverview of CMP 08

- checkOverview of GSTR 5

- checkOverview of GSTR 6

- checkOverview of GSTR 7

- checkOverview of GSTR 8

- checkOverview of GSTR 9 (Annual Return)

- checkOverview of GSTR 9C

- checkOverview of GSTR 10 (Final Return)

Tax Invoice, Debit Note & Credit Note in GST

- checkTax Invoice provisions and rules

- checkDebit note and Credit note provisions

- checke-invoicing

Live Session on GST Portal

- checkOverview of GST Portal

- checkHow to search HSN Code?

- checkHow to verify GSTIN?

- checkElectronic Credit Ledger

- checkElectronic Cash Ledger

- checkElectronic Liability Register

IFF under GST

- checkWhat is IFF Filing

- checkUnderstand the IFF Tables

- checkFiling of IFF

ITC Reconciliation

- checkHow to arrange data

- checkUsing Excel for Reconciliation

- checkReconciliation of Tally Data (ITC) with GSTR2B

- checkMatching Data with the help of Advance Excel

- checkIdentify the default supplier in Excel

- checkFollow up with suppliers

Practical sessions on GSTR 1A

- checkWhat is GSTR-1A Return Form

- checkHow to add and amend records in GSTR-1A in Detailed

Practical session on IMS (Invoice Management System)

- checkWhat is accept, reject and pending option in ims

- checkHow to work on IMS Dashboard

Practical sessions on GSTR 1 and GSTR 1A

- checkUnderstand Tables of GSTR 1

- checkHow to enter B2B supply in GSTR 1

- checkHow to enter B2C supply in GSTR 1

- checkHow to enter B2CL supply in GSTR1

- checkHow to enter debit note and credit note (Registered & Un Registered)

- checkHow to enter export invoices (Table 6A)

- checkAdvance in GSTR1

- checkAdjustment against Advance in GSTR1

- checkSupply made through E-Commerce

- checkSupply u/s 9 (5)

- checkHSN-wise reporting in GSTR 1

- checkDocument-wise reporting in GSTR 1

- checkAmend B2B in GSTR1

- checkAmend B2C in GSTR1

- checkAmend Debit note & Credit Note

- checkFilling online GSTR1

- checkUse of offline tool for GSTR 1 Filing

- checkPrepare JSON file for offline GSTR 1 Filing

- checkErrors in JSON preparation

- checkFiling of GSTR 1

Practical session on GSTR 2A

- checkUnderstand tables of GSTR 2A Statement

- checkDifference between GSTR 2A & GSTR 2B

- checkAnalysis of GSTR 2A on GST Portal

Practical session on GSTR 2B

- checkUnderstand tables of GSTR 2B Statement

- checkAnalysis GSTR 2B on GST Portal

Practical session on GSTR 3B (Regular)

- checkUnderstand Tables of GSTR 3B

- checkSupplies to be enter under table 3.1

- checkSupplies to be enter under table 3.2

- checkITC to be claim in table 4

- checkReversal of ITC in GSTR 3B

- checkChallan preparation and payment on GST Portal

- checkSetoff GST liability (Offset)

- checkFiling of GSTR 3B

Practical session on GSTR 3B (QRMP)

- checkPoints to remember for quarterly 3B

- checkUnderstand Tables of GSTR 3B

- checkSupplies to be enter under table 3.1

- checkSupplies to be enter under table 3.2

- checkITC to be claim in table 4

- checkReversal of ITC in GSTR 3B

- checkChallan preparation and payment on GST Portal

- checkSetoff GST liability

- checkFiling of GSTR 3B Quarterly

Practical session on GST Computation

- checkLearn to prepare data for GST Filing

- checkUse of Excel for data preparation

- checkClassification of taxable, zero rated and exempt supply

- checkClassification of eligible and ineligible ITC

- checkITC set off provisions and its application in computation

- checkApplication of Rule 36(4)

- checkMapping GSTR 2B and Book ITC data

- checkFinalizing data for GST Returns

Supply through E Commerce Operator (Online Seller)

- checkAmazon, Flipkart, Meesho Sellers GST Computation

- checkTCS computation

- checkFiling GSTR 1 and GSTR 3B for online sellers

Practical session on e invoicing

- checkIntro to e invoice

- checkGePP Tool for generating e invoice

- checkOverview and limitation of GePP tool for e invoicing

- checkAdd Supplier Master in GePP tool

- checkAdd Recipient Master in GePP tool

- checkAdd Product Master in GePP tool

- checkFiling Data for e invoicing in GePP tool

- checkGenerating JSON file from GePP tool

- checkHow to generate IRN and e invoicing

- checkHow to cancel e invoice

- checkTime limit for canceling e invoice

- checkValidating and Preparing JSON in Form A for e invoicing

- checkBulk e invoicing cancellation

Income Tax Course ...

You will be Learning the following things...

Basic Concepts of Income Tax

- Overview of Income Tax & Direct Tax

- Important definitions

- Previous Year and Assessment Year

- Charge of Income Tax

- Types of Assessee

- Rate of Tax for different assessee

- Surcharge, Health & education cess

- Gross Total Income & Total Income

- Rebate of (Sec 87A)

Valuation of perquisites

- Valuation of Rent Free Accommodation (RFA)

- Valuation of Motor Car Facility

Income under the head Salary

- Basis of Charge (Sec 15)

- Different type of allowances

- HRA Calculation [Sec 10(13A)]

- Calculation of Provident Fund as updated

- Overview of Forms related to Salary

- Overview of Form 24Q -TDS Return for Salary

- Form 16 – TDS Statement

- Form 12B – Details of income from previous employer

- Form 12BA – Statement of perquisites

- Form 12BB – Particulars of deduction claims by employee

Income under the head House Property

- Chargeability (Sec 22)

- Condition of Chargeability

- Composite Rent

- Deemed Let out Property

- Determination of Annual Value (Sec 23)

- Deduction from Annual Value (Sec 24)

- Standard Deduction

- Interest on Loan

- Unrealized rent treatment

- Deemed ownership

Income under the head Business & Profession

- Chargeability (Sec 28)

- Method of Accounting

- Income computation & disclosure standards (ICDS)

- Speculative Business & Specified Business

- Calculation of Depreciation

- Admissible Deduction (Sec 30 to 37)

- Inadmissible deduction (Sec 40)

- Maintenance of Accounts (Sec 40AA)

- Audit of Accounts (Sec 44AB)

- Presumptive Taxation (Sec 44AD, 44ADA, 44AE)

Income under the head other sources

- Chargeability (Sec 56)

- Tax rate on casual income (Sec 115BB)

- Deduction allowed (Sec 57)

- Deduction not allow (Sec 58)

- Deemed income chargeable to tax (Sec 59)

- Method of Accounting (Sec 145)

Income Tax Rebate (Deductions under Chapter VI-A)

- Under Section 80C

- Under Section 80CCC

- Under Section 80CCD(1)

- Under Section 80CCC (2)

- Under Section 80CCD (1B)

- Under Section 80E

- Under Section 80G

- Under Section 80TTA

- Under Section 80D

- Under Section 80DD

- Under Section 80U

- Under Section 80GG

Aggregation of income, Set off & Carry forward of Losses

- Aggregation of Income

- Concept of set off & carry forward of losses

Advance Tax

- Concept of Advance Tax

- Interest on Advance Tax

Practical Session on New Income Tax Portal

- Overview of New Income Tax Portal

- How to register on Income Tax Portal

- How to reset password

- Overview of Form 26AS

- Overview of Annual Information Statement (AIS)

- How to give feedback in AIS

- Overview of TIS

- Interlinkage between AIS, TIS & ITR

- Concept of Updated Return

Practical Session on ITR 1 Filing

- How to make pan based user id & password in Income Tax Portal

- How to make TAN based user id & password in Income Tax Portal

- Eligibility to file ITR 1

- Documents need to file ITR 1

- Overview of ITR 1 Form

- How to file ITR-1 in detail for Salaried Employee

- Excel Computation for ITR 1

- Online ITR 1 Filing

Practical Session on ITR 4 Filing

- Eligibility to file ITR 4

- Presumptive Taxation

- Online ITR 4 Filing

Account Finalization

- Balance Sheet & P&L Preparation

- Adjustment Entry

- Projected Financials

Payroll Management

(Payroll Processing in Tally Prime and Reports)

You will be Learning the following things...

Payroll Management (Payroll in Tally Prime 5.0 & Excel)

- Calculate CTC

- Salary structure (breakup)

- Leave

- Allowances

- Perquisites

Labour Law Statutory Compliances & Computation:

- What is a covered establishment?

- PF Deposit Date

- HRA Calculation [Sec 10(13A)]

Employee State Insurance – ESI

- What is a covered establishment?

Professional Tax – PTAX (PT)

- Professional tax applicability

- Professional tax slab state-wise

Tax calculation, Tax Saving Investment Deductions and Exemptions:

- Tax Deduction at Source – TDS

- What is Income-tax?

- Income tax slabs and Income tax Computation

Deduction (u/s 80C – u/s 80U) of Chapter VI-A of Income Tax Act, 1961

- Deductions under section 80C.

- Deductions under section 80D, 80E, 80U.

- Deductions under section 80DD, 80DDB, 80CD2

- Deductions under section 80G, 80GG, 80GGA,

- Deductions under

- Validation or Examination of Investment Proofs and Reimbursement Claims

- Investment Proofs examination Under section 80C

- Investment proofs examination others

- Expense Bill examination of Reimbursements

- Limit of Deductions and max eligibility up to Pro Rata, Previous Employer Income.

Provident Fund

- How to calculate PF on salary

- How to create PF Chalan

Tax Deducted At Source Course

You will be Learning the following things...

What is TDS Rules In India

- Sec 192 TDS on Salary Computation

- Sec 194C TDS on Contract

- Sec 194D TDS on insurance commission

- Sec 194H TDS on commission and Brokerage

- Sec 194I TDS on Rent

- Sec 194J TDS on Professional & Technical Services

- Sec 194O TDS on E comm transactions

- Sec 194Q TDS on Purchase of Goods

- Sec 194R TDS on Benefits & Perquisites

- Sec 194T TDS on Payment to Partners

- Sec 206AB Higher Rate of TDS

- Sec 206C(1H) TCS on Sales of Goods

- Income Slab for General

- Income Tax Slab for Senior Citizen

- Income Tax Slab for Very Senior Citizen

- Income Tax Slab for New Tax Regime

- All Types of Journal Entries for Tds (In The Books of Deductor & Deductee)

- How to make online TDS payment

- How to keep proper records of paid challan to file E TDS Return

- How to download CSI File?

- How to download Free TDS Utility Software and Java

- Practical session on Form 24Q – Salary TDS Return

- Practical Session on Form 26Q – Other than Salary TDS Return

- Practical Session on Form 27EQ – TCS Return sale of Goods

- How To Download Tds Certificates?

- How to file revised TDS Return?

- How to add and correction TDS Challan

Tax Collected At Source Course

You will be Learning the following things...

TCS

- Classification of Sellers under TCS

- Classification of Buyers under TCS

- Classification of Goods under TCS with section

- How to calculate TCS on sale of goods

- TCS exemptions

- How to create TCS Challan

- How to File Online TCS Return

- How to Download TCS Certificates

- TCS Accounting in Tally Prime

Import Excel Data to Tally Prime 5.1

Import Excel Data

- Import Excel Data to Tally Prime

- How to import excel bank statement data to tally prime

- How to import purchase data with gst to tally prime

- How to import sale data with gst to tally prime

Over 10,000+ Happy clients

What People Say About Our Product

Claim All Bonuses+ Premium Support & Free Sheets & Notes Now!

Get Lifetime Validity + Support

Get 62% Discount Now

₹15,999

₹5997 only for Today

Taxation Mastery Course

Course

100% Money-Back Guarantee

With our 100% Money-Back Guarantee, you can enroll in the course risk-free, as we promise a full refund If the lecture you've purchased is not delivered as promised, we offer a full money-back guarantee. Your satisfaction is our priority.

100% Secure Checkout

Our "100% Secure Checkout" ensures that your payment information and personal data are fully protected, providing you with a safe and worry-free online purchasing experience.

Frequently Asked Questions

How will I get the access?

After the Payment, You'll get the access on your Email within 12 working hours

Validity of the course?

If you enrolled in the offer period You'll get Lifetime Validity.

How will I get PDF Notes & Bonuses?

you'll get your PDF notes & Bonuses with your Course Content.

Can I Download PDF Notes?

Yes, You can download PDF Notes & sheets.

Can I download the videos?

The Videos are shared in the member’s area, you cannot download them however you can watch them anytime you want – any number of times you want. All you need is a Mobile/Laptop and an Internet connection.

Is it a recorded course or a live course?

It’s a recorded course, You get all modules in 1 go and you can watch them at your own pace

How long will it take to complete the course?

As the course is completely self-paced, there is no set schedule for you to complete the course. You learn at your pace!

What Is the Duration Of the Course?

The Course Duration is more the 125 hours. and we keep updating our course. you'll get always updated classes, we remove old classes in the course.

Who is the Trainer of the Course?

All the Lessons have been taken by MD Shafi Ahmad.

How will I get the Certificate.

You will get your Certificate in your Profile Section. You can Download your Certificate.

How will I get Support?

You can Directly call us, We'll provide you Direct contact Number.

Who is going to Resolve my Query?

Self Md Shafi Ahmad Will assist you on your Query.

© 2023 The Accounts. All Rights Reserved | Design by Digital Market AddA