Apply "LIVEGST" Coupon at Checkout Get ₹3000 off, Expiring on 17th of February.

Master GST & Boost Your Income –

Secure a Stable Career, Get Promotions Faster & Achieve Financial Freedom

Learn the essentials of GST—rules, updates, and filing returns—through easy-to-understand notes, PDFs, Excel sheets, and live interactive classes. Whether you're new to taxes or aiming to become a tax professional, this course explains everything clearly and stays updated with the latest laws. By the end, you'll confidently handle GST and solve tax-related issues. Start your tax journey now and become a pro in GST!

89.6% sold out!

Master GST & Boost Your Income – Secure a Stable Career, Get Promotions Faster & Achieve Financial Freedom

Master GST with this course! Learn rules, updates, and filing returns through easy-to-understand notes, PDFs, Excel sheets, and live interactive classes. Suitable for beginners and experienced learners, this course keeps you updated with the latest laws. By the end, you'll confidently handle GST, tackle GST-related issues, and stay compliant with new regulations. Join now and become a GST Pro!

89.6% sold out!

Expert Instructors

Learn from expert instructors with 18 years of experience and more then 400K YouTube subscribers. Gain industry insights and practical knowledge from the best in the field!

Exclusive Resources

Get exclusive resources like detailed notes, PDFs, Excel sheets, and live interactive classes to make learning easy and effective!

Career Advancement

Boost your career with in-demand GST skills and become a tax professional. Gain expertise to handle real-world tax challenges confidently!

Our Mission and Motto

The Course empowers accountants and beginners to secure high-paying MNC jobs or launch a successful tax consulting business.

- Highly Interactive Practical Sessions

- Access the Course anywhere you want, Mobile, PC, Laptop & TV

- Get Government ISO Certified Certificate

- Full support for lifetime

- Unlimited views:- Course with unlimited views.

- LIFETIME VALIDITY:- watch your course whenever needed

one time Investment

Hurry Up! Don't Miss The Opportunity

What You’ll Get in This Masterclass

The Most Comprehensive Course Covering all the Practical Elements of GST Filing with Law

Master GST Rules & Provisions

- Understand key GST provisions and their applicability.

- Learn about CGST rules, including the latest amendments.

- Identify different types of supply under GST.

- Analyze the impact of GST Council meeting decisions.

- Stay updated with amendments, including FA 2025

GST Registration & Compliance

- Step-by-step process for GST registration.

- Learn about the QRMP Scheme, IFF Facility & PMT-06.

- Understand eligibility and compliance for different taxpayers.

- Avoid common mistakes in registration and compliance.

- Manage amendments and cancellations in GST registration.

GST Return Filing Made Easy

- Learn to file GSTR-3B for monthly GST payments.

- File GSTR-1 for outward supplies with accuracy.

- Understand GSTR-9 annual return filing with practical examples.

- Learn return filing for composite suppliers (CMP-08 & GSTR-4).

- Avoid penalties and errors in GST return filing.

E-Invoicing & ITC Computation

- Understand e-invoicing requirements and compliance.

- Learn Input Tax Credit (ITC) computation and set-off rules.

- Stepwise GST computation with real-world scenarios.

- Learn to reconcile ITC with GSTR-2A & GSTR-2B.

- Manage ITC claims to optimize tax savings.

GST Council Meeting Insights

- Stay updated with key decisions and policy changes.

- Understand amendments and their impact on businesses.

- Analyze case studies from past GST Council meetings.

- Learn about changes in tax rates and exemptions.

- Implement best practices based on council updates.

Variance & Reconciliation Techniques

- Identify and resolve variances in GSTR-1, GSTR-2B, and GSTR-3B.

- Learn techniques for accurate GST reconciliation.

- Manage discrepancies between books and GST returns.

- Understand the importance of timely corrections and amendments.

- Improve tax compliance through effective reconciliation methods.

Who is this masterclass for?

CA, CS, CMA Aspirants & Professionals

Gain practical exposure to GST compliance, filing, and advisory.

Advocates & Legal Experts

Learn the legal framework, amendments, and GST dispute resolution.

Accountants & Finance Professionals

Improve tax filing accuracy and GST compliance for businesses.

B.Com & Commerce Graduates

Get hands-on experience in GST compliance and career-ready skills.

Tax Consultants & Professionals

Upgrade your expertise to provide GST consultancy services effectively.

GST Inspectors & Officers

Build a strong foundation to crack GST-related work.

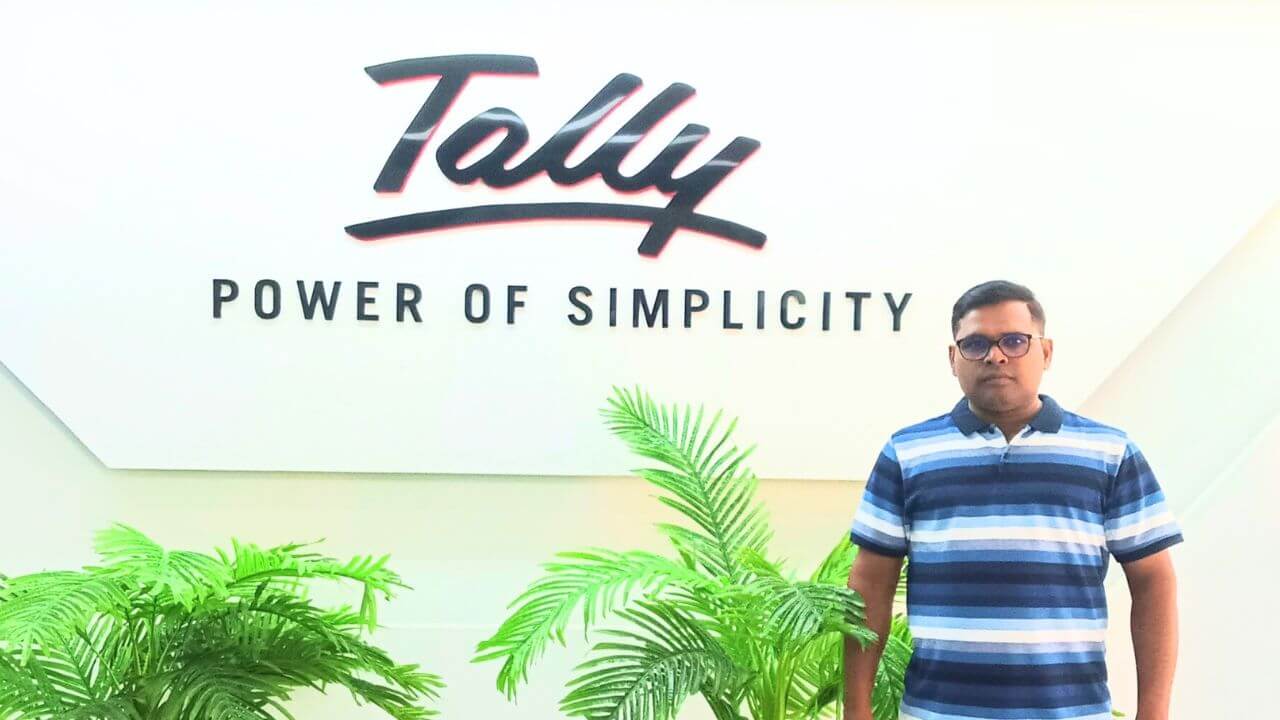

meet your mentor

MD shafi Ahmad

- Expert in Accounting, Taxation and a youtuber with 422K Subscribers

an award-winning tax and accounting professional with 18+ years of experience, including international expertise in India and Oman. He has trained over 1,00,000 students, helping many secure top jobs in MNCs.

A passionate educator and industry expert, he is committed to making financial knowledge accessible to all. His YouTube channel, The Accounts, with 4+ lakh subscribers, simplifies complex taxation concepts for aspiring professionals.

testimonials

Meha Vyas

This course bost the confidence level. Help us to resolve practicle queries. Also SHFI sir teach us in a very well manner step by step . He covers all the topic and each point which is very useful for growth in a accounting carrier. Thank you so much sir.

Md Razaullah

In today's era many institutions run but the way of teaching and experience (The Accounts) and Shafi sir's are praise worthy, that's why I thank Shafi sir from the bottom of my heart.

Ankit Malviya

Great Course. I learned a lot. The most important part is that I enjoy every bit of the lession and completed everything.

FAQ's

1. How will I get Support?

You can Directly call us, We'll provide you Direct contact Number.

2. How will I get PDF Notes & Bonuses?

you'll get your PDF notes & Bonuses with your Course Content.

3. Can I download the videos?

The Videos are shared in the member’s area, you cannot download them however you can watch them anytime you want – any number of times you want. All you need is a Mobile/Laptop and an Internet connection.

4. How will I get the access?

You'll get the access immediately on you Email, after completing your payment.

5. How will I get the Certificate.

You will get your Certificate in your Profile Section. You can Download your Certificate

6. What Is the Duration Of the Course?

The Course Duration is more the 50 hours. and we keep updating our course. you'll get always updated classes, we remove old classes in the course.

7. Is it a recorded course or a live course?

It’s a recorded course, You get all modules in 1 go and you can watch them at your own pace

8. Validity of the course?

If you enrolled in the offer period You'll get Lifetime Validity.

Expert Instructors

Learn from expert instructors with 18 years of experience and 400K YouTube subscribers. Gain industry insights and practical knowledge from the best in the field!

Exclusive Resources

Get exclusive resources like detailed notes, PDFs, Excel sheets, and live interactive classes to make learning easy and effective!

Career Advancement

Boost your career with in-demand GST skills and become a tax professional. Gain expertise to handle real-world tax challenges confidently!

Our Mission and Motto

The Course empowers accountants and beginners to secure high-paying MNC jobs or launch a successful tax consulting business.

- Highly Interactive Practical Sessions

- Access the Course anywhere you want, Mobile, PC, Laptop & TV

- Get Government ISO Certified Certificate

- Full support for lifetime

- Unlimited views:- Course with unlimited views.

- LIFETIME VALIDITY:- watch your course whenever needed

one time Investment

Hurry Up! Don't Miss The Opportunity

What You’ll Get in This Masterclass

The Most Comprehensive Course Covering all the Practical Elements of GST Filing with Law

Master GST Rules & Provisions

- Understand key GST provisions and their applicability.

- Learn about CGST rules, including the latest amendments.

- Identify different types of supply under GST.

- Analyze the impact of GST Council meeting decisions.

- Stay updated with amendments, including FA 2025

GST Registration & Compliance

- Step-by-step process for GST registration.

- Learn about the QRMP Scheme, IFF Facility & PMT-06.

- Understand eligibility and compliance for different taxpayers.

- Avoid common mistakes in registration and compliance.

- Manage amendments and cancellations in GST registration.

GST Return Filing Made Easy

- Learn to file GSTR-3B for monthly GST payments.

- File GSTR-1 for outward supplies with accuracy.

- Understand GSTR-9 annual return filing with practical examples.

- Learn return filing for composite suppliers (CMP-08 & GSTR-4).

- Avoid penalties and errors in GST return filing.

E-Invoicing & ITC Computation

- Understand e-invoicing requirements and compliance.

- Learn Input Tax Credit (ITC) computation and set-off rules.

- Stepwise GST computation with real-world scenarios.

- Learn to reconcile ITC with GSTR-2A & GSTR-2B.

- Manage ITC claims to optimize tax savings.

GST Council Meeting Insights

- Stay updated with key decisions and policy changes.

- Understand amendments and their impact on businesses.

- Analyze case studies from past GST Council meetings.

- Learn about changes in tax rates and exemptions.

- Implement best practices based on council updates.

Variance & Reconciliation Techniques

- Identify and resolve variances in GSTR-1, GSTR-2B, and GSTR-3B.

- Learn techniques for accurate GST reconciliation.

- Manage discrepancies between books and GST returns.

- Understand the importance of timely corrections and amendments.

- Improve tax compliance through effective reconciliation methods.

Who is this masterclass for?

CA, CS, CMA Aspirants & Professionals

Gain practical exposure to GST compliance, filing, and advisory.

Advocates & Legal Experts

Learn the legal framework, amendments, and GST dispute resolution.

Accountants & Finance Professionals

Improve tax filing accuracy and GST compliance for businesses.

B.Com & Commerce Graduates

Get hands-on experience in GST compliance and career-ready skills.

Tax Consultants & Professionals

Upgrade your expertise to provide GST consultancy services effectively.

GST Inspectors & Officers

uild a strong foundation to crack GST-related work.

meet your mentor

MD shafi Ahmad

- Expert in Accounting, Taxation and a youtuber with 422K Subscribers

an award-winning tax and accounting professional with 18+ years of experience, including international expertise in India and Oman. He has trained over 1,00,000 students, helping many secure top jobs in MNCs.

A passionate educator and industry expert, he is committed to making financial knowledge accessible to all. His YouTube channel, The Accounts, with 4+ lakh subscribers, simplifies complex taxation concepts for aspiring professionals.

testimonials

Meha Vyas

This course bost the confidence level. Help us to resolve practicle queries. Also SHFI sir teach us in a very well manner step by step . He covers all the topic and each point which is very useful for growth in a accounting carrier. Thank you so much sir.

Md Razaullah

In today's era many institutions run but the way of teaching and experience (The Accounts) and Shafi sir's are praise worthy, that's why I thank Shafi sir from the bottom of my heart.

Ankit Malviya

Great Course. I learned a lot. The most important part is that I enjoy every bit of the lession and completed everything.

FAQ's

1. How will I get Support?

You can Directly call us, We'll provide you Direct contact Number.

2. How will I get PDF Notes & Bonuses?

you'll get your PDF notes & Bonuses with your Course Content.

3. Can I download the videos?

The Videos are shared in the member’s area, you cannot download them however you can watch them anytime you want – any number of times you want. All you need is a Mobile/Laptop and an Internet connection.

4. How will I get the access?

You'll get the access immediately after completing your payment.

5. How will I get the Certificate.

You will get your Certificate in your Profile Section. You can Download your Certificate

6. What Is the Duration Of the Course?

The Course Duration is more the 50 hours. and we keep updating our course. you'll get always updated classes, we remove old classes in the course.

7. Is it a recorded course or a live course?

It’s a recorded course, You get all modules in 1 go and you can watch them at your own pace

8. Validity of the course?

If you enrolled in the offer period You'll get Lifetime Validity.

All Rights Reserved | Designed by Digital Market AddA